INSAAF exists to fulfil the increasing need for Muslim communities searching for financial solutions with experts in both areas to create an aligned result of equipment, vehicles or business success. Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith. On Friday NAB will officially launch sharia-compliant loans of over $5 million for commercial property and construction, the first of the Big Four banks to do so. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice.

We offer an alternative solution for Muslims in an Australian landscape. With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” the CEO added. Similarly, for personal finance – Islamic Bank Australia would purchase the item and then sell it to the customer.

The challenge lies in keeping up with the pace that society is changing — and technology is at the forefront for influencing those societal changes. The Rudd Government is acting to ensure our country is attractive to Islamic financial investment and facilitates greater involvement with this important sector of the global economy. Australia's largest investment bank, Macquarie Group, has also announced plans for an Islamic finance joint venture with the Bahrain-based Gulf Finance House to target markets in the Middle East and North Africa. Australia is well aware of the potential for Islamic finance in developing our nation as a financial services centre.

However, Australia’s credit laws still apply and the lender will still charge you for borrowing money. And the implications are vast, not only does this tick the box for inclusion, but so too does it begin to grow brand gravity. We also recognise there are Muslims in Australia who would use Islamic financial services if they were more accessible.

And of course, this Islamic Bank Home Loan opportunity is not limited to domestic Australian markets. Leading Australian firms will seek out opportunities to become involved in offering Islamic finance products in the global market so they can tap alternative funding sources and invest in new areas. On 13 October 2010, the Board of Taxation released itsdiscussion paper on the reviewof the taxation treatment of Islamic finance, banking and insurance products. The Chairman of the Board of Taxation announced the release of the discussion paper viaa press release. The Board has developed this discussion paper to facilitate stakeholder consultation. On 3 May 2016, the Government announced the release of the Board’sfinal reporton the taxation treatment of Islamic finance, banking and insurance products.

The purchase of a property is typically financed through a mortgage agreement where the property is financed through borrowed funds from the lender. The borrower is required to repay this loan amount, plus interest, via a predetermined repayment schedule. Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with shariah . The epitome of financial inclusion is allowing consumers to make financial decisions through multiple product options and channels that meet their needs without compromising their values or wellbeing. This can only be achieved when banks adopt a customer behaviour-centric approach to innovation. The rise of Islamic banking is just the beginning of a much larger discussion around ethical banking and financial inclusion, one which banks have struggled to stay on top of for years, if not decades to now.

If you have concerns or in need of financial help, get in touch with our team today. Insaaf has all the tools to help your business grow financially and Shariah complied. Being able to work with a team who understands our unique requirements has made the whole process seamless,” said their managing directors, Amen Zoabi and Khalil Hafza.

MCCA’s finance products stand apart from other options open to Australian Muslims. When it comes to making our community’s dreams come true, MCCA has a strong track record in delivering excellence. Thank you Insaaf and team for helping me sorting out my vehicle finance. I live in interstate and I had all the communication with them either over the phone or via email. I faced no difficulty dealing with Insaaf and the financing process was very smooth. This course provides a detailed background on the religious foundations, history, and political economy of the emergence of modern Islamic Banking, as well as introducing basic ideas and common products in Islamic Finance.

Shariah-compliant banking

This particular account follows the Islamic principle of Wadiah–safe-keeping your funds with a financial institution–and is approved by several Islamic scholars. "Getting a banking licence is a fairly challenging thing to do in any case, but trying to start an Islamic bank in a country where almost nothing is set up to support Islamic banking is really challenging," he says. Only four R-ADIs have been granted, and one licence has already been handed back after the institution, Xinja, failed and had return all of its customers' money. Now two small local entities are trying to have another crack at setting up an Islamic bank in Australia using a new form of banking licence set up by the financial regulator, APRA.

Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. We try to take an open and transparent approach and provide a broad-based comparison service.

The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you.

We’ve taken the mortgage from them, and secured a transaction agreement that doesn’t express principal or interest. 'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently. Just like any other everyday account, you’ll have the option to have physical and digital cards.

Sharia law also prohibits financing pornography, alcohol and gambling. Mr Gillespie said IBA had extended the remit for ethical banking to exclude live animal exports, big polluters and weapons. The tax treatment of Islamic financial products should be based on their economic substance rather than their form. "The Bahrain Central Bank made a very generous offer today to work with Australian regulators as we boost our readiness for a range of Shariah-compliant products, both wholesale and retail." Typically everyday bank accounts under Sharia Law do not accumulate any interest.

Saving People from Riba

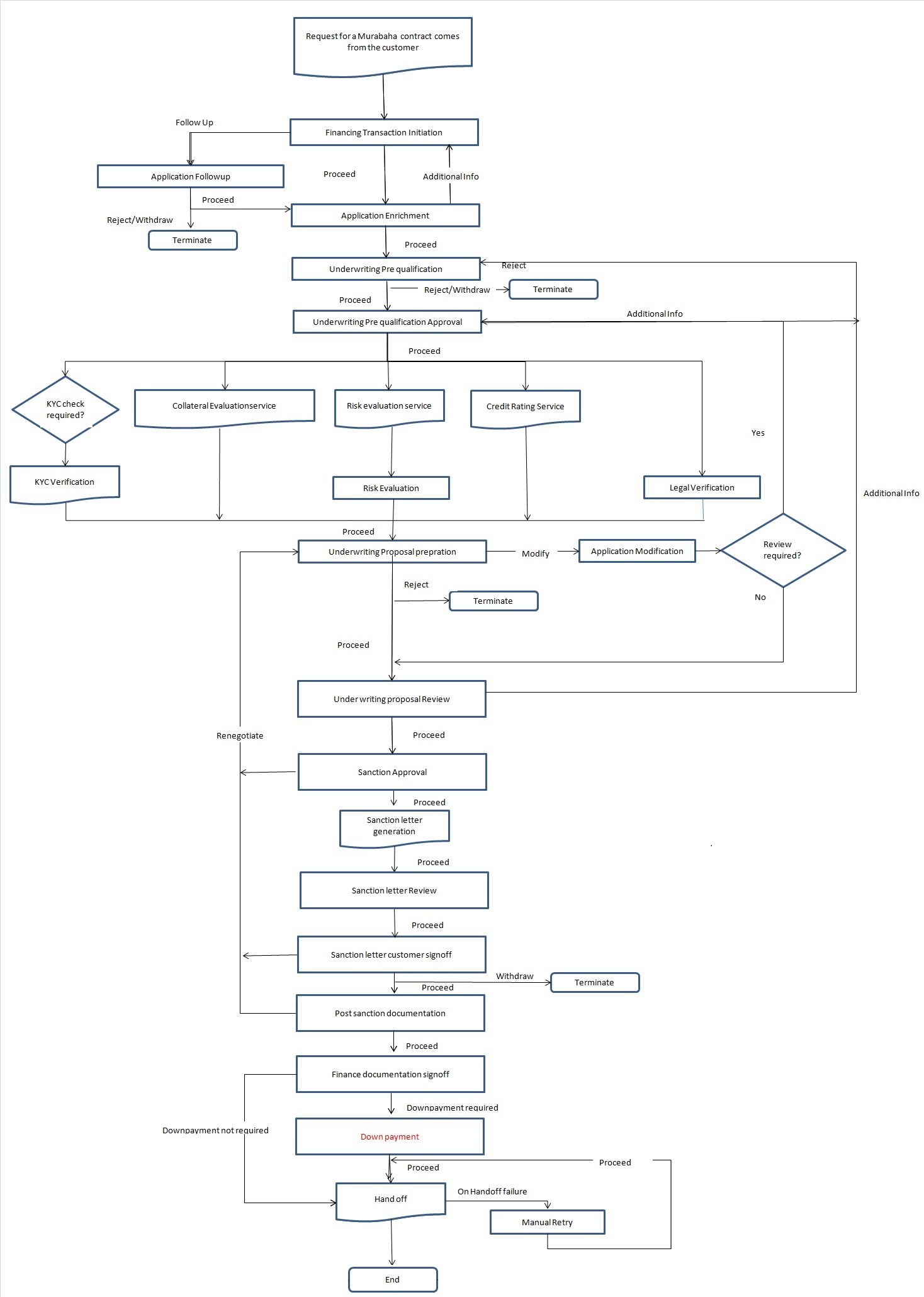

Another financing company, Hejaz Financial Services, which is already in the home loan and superannuation space, says it has also just started the process of applying for Islamic Bank Mortgage a R-ADI. Murabaha financing is a method of Islamic financing commonly found in the Middle East and the Asian subcontinent. It occurs by way of a contract where an Islamic financier, upon the request of a customer, purchases an asset from a vendor and resells it to the customer with an agreed profit margin. The customer then makes periodic payments of an agreed amount over a set period of time. Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Products Halal Loans marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product.

The bank has legal claims to the home, and can repossess and force you to sell it if you default on your loan. The bank or financing company makes its profit through the interest and fees. Interest is everywhere – it's tied to home loans, Sharia Loans deposit accounts, credit cards, and is meticulously manipulated by our own central bank. This differs from a traditional home loan, in which a lender extends credit to a borrower who repays the loan with interest. Monies used for loan funding must be obtained from compliant sources such as Islamic or ethical investment funds.

Remember, if you change your mind cancelling a sale may become an expensive exercise. To get started we will conduct an initial pre-assessment to determine how much we can finance you and whether you will fit the requirements for eligibility. The information you provide us here will be verified with supporting documents which we will ask you to provide later. We have been recognised for our commitment to client service having been awarded the Best Islamic Finance Institution for three consecutive years by the prestigious. The Islamic Finance News awards honour the best in the Islamic finance industry and are one of the most prestigious awards highly recognised by global Islamic finance capital markets.

Although we cover a range of products, providers and services we don't cover every product, provider or service available in the market. Products compared may not compare all features and options that may be relevant you. The information and products contained on this website do not constitute recommendations or suggestions to purchase or apply for any particular product. Any advice provided on this website is of a general nature and does not take into account your objectives, financial situation or needs. Products included on this site may not suit your personal objectives, financial situation or needs. InfoChoice is not a product issuer or a credit provider and does not provide personal financial advice or credit assistance.

It is also permissible to use a third party property as a security mortgage. "The difference between Islamic and Western banking is the notion of interest rates," says Nail Aykan, marketing manager with the Muslim Community Cooperative of Australia . "In the Islamic beliefs, the interest rate is forbidden, hence there must be an alternative." APRA has issued a restricted authorised deposit-taking institution licence to IBA Group, establishing the company’s brand Islamic Bank Australia as the country’s first Islamic Sharia Compliant Loans Australia bank. To help you navigate the complex world of finance, insurance and utilities, we are committed to offering you a free service to help find you the right product to suit your needs. By providing you with the ability to apply for an insurance quote or a credit facility we are not guaranteeing that your application will be approved.

It’s rare for institutions to suggest Islamic mortgages to non-Muslims simply because there’s not much extra benefit to be had if you’re not concerned about adhering to religious principles. Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . As you can see, the main difference between a conventional mortgage and a Sharia home loan is that the Sharia mortgage works by rent and a regular loan uses interest. A home loan is a musharakah contract in which one party – you – buys the equity share of the other party in instalments until they’ve bought the property in full. Islamic law states that both parties share the gains and losses involved in the transaction.

The LVR ratio refers to the amount of the property value or purchase price you can borrow from the lender. A loan with a high insured LVR allows you to borrow funds without paying lenders mortgage insurance . With its current APRA restricted licence, Islamic Bank Australia can only have a limited number of customers in 2023.

Eventually, the asset is wholly paid off by the client and they own the house outright. You may approach any of the Islamic banking institutions listed above that offer Sharia-compliant products to know your options. Better still, you enlist the services of a mortgage broker who can best help you find a suitable financing. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements.

The future of Islamic banking in the western countries, what we need to know

Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bil Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease period. If the idea of owing your own property, vehicle or equipment via Ijarah appeals to you but you are currently paying off an existing mortgage we can help you replace it. Looking to make a change from the city life to the country life?

To get into the housing market, he sees little alternative to a conventional mortgage. Currently, the Islamic finance product is only available for business customers. As such, NAB has announced that it has launched new products designed to meet Islamic Sharia Law requirements, where the product structures financing as a lease where ‘rent’ and ‘service fee’ are paid instead of ‘interest’.

“It’s the flexibility of the link between those two funds that should be attractive – a choice of income or capital, drawing on the benefits of both,” Dr Hewson said. The data, which is derived from a June survey of 1,002 broker customers and conducted by Honeycomb Strategy,… Hejaz Financial Services has been active in Australia for over a decade and assists Muslims in making various aspects of Australian finance, such as Supers and Investment, compliant with their religious beliefs. You’ll receive the latest industry news, tips and offers straight to your inbox. Many of our members are hard-working Muslims, who have been looking to earn a flexible income by becoming rideshare drivers.

These have included, Datuk Dr Daud Bakar and Professor Sheikh Ali El Gari . That said, after several years of working with scholars, Australia lawyers, regulators and suitable funding sources, we opened our doors to the public with our Islamic finance solutions in 2015. How ICFAL gives you the chance to Shariah Compliant investment and financing. Marking 25 years in operation, we are excited to share our brand new visual identity.

However, this will depend on how the financial institution determines the profit made on the sale. The fundamental difference between a typical home loan and a Sharia-compliant home loan is in the borrowing terms used (i.e. interest with a typical home loan vs rental or profit fee with an Islamic home loan). “Ours is a common mortgage transaction that’s fully functional. The bank has security over the property, which means that if the borrower defaults on their home loan, the lender can enforce a sale of the property to recover the outstanding funds that are owed. Another financing company, Hejaz Financial Services, which is already in the home loan and superannuation space, says it has also just started the process of applying for a R-ADI.

They also come in full documentation and low documentation versions, depending on your leasing needs. On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market.

This method of Islamic financing differs from a traditional loan in that monies are not simply extended by the financier to the customer for the purchase of an asset, as is the case with a traditional loan. Rather, an asset is purchased by the financier and then sold to the customer. Murabaha financing is a method of Islamic financing commonly found in the Middle East and the Asian subcontinent. It occurs by way of a contract where an Islamic financier, upon the request of a customer, purchases an asset from a vendor and resells it to the customer with an agreed profit margin. The customer then makes periodic payments of an agreed amount over a set period of time. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance.

They may stop if their business fails or when they retire. All partners involved in the venture contribute capital from their savings. There is no clear way to resolve these defaults, though the buyer and seller can work out an arrangement.

It complies with Islamic law and serves a function similar to a bond. It refers to gambling, which is illegal for the same reasons as Gharar. No Muslim can have involvement in any contract where the ownership of property depends on uncertain events. Islamic law regards Gharar as unethical because it is inequitable. One person in the interaction has an advantage in knowledge or resources.

A Beginner's Guide to Halal Home Loans

Our products have been developed in close collaboration with some of the world’s leading Islamic finance scholars. These have included, Datuk Dr Daud Bakar and Professor Sheikh Ali El Gari . That said, after several years of working with scholars, Australia lawyers, regulators and suitable funding sources, we opened our doors to the public with our Islamic finance solutions in 2015. Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bil Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease period.

I live in interstate and I had all the communication with them either over the phone or via email. I faced no difficulty dealing with Insaaf and the financing process was very smooth. Insaaf has all the tools to help your business grow financially and Shariah complied. Insaaf has the best car finance options to give you the best deals for your new set of wheels. For more business news and analysis, visit NAB’s Business Research and Insights.

But after the couple married in 2018, they started using an Islamic financing company to buy property. Before the couple met, Melike had also previously taken out a traditional home loan with Commonwealth Bank. With roughly 600,000 people identifying as Muslim in Australia, industry reports place the potential size of this market in Australia at $250 billion.

The information we request will vary